6 Ways to Manage Your Complicated Solar Projects

Back in 1997, the price of a solar panel was approximately 227 times higher than what it is today. To be specific, the rate stood at $101.5 per watt back then, and it is currently at $0.447 per watt. Moreover, the US stands at number 3 as the country with the leading annual solar power installations.

In fact, there is a new solar panel system installed every 4 minutes. These numbers reveal the lucrative market for solar PV systems. On top of that, more and more people are becoming aware of the need for clean energy, another reason why the solar market is doing so well.

Having a solid market demand, however, does not mean that your solar business is going to run smoothly. If anything, complicated solar projects are common. Only effective management can prevent roadblocks.

In this context, here are some useful tips for managing your complicated solar projects;

1. Sit and discuss the issue with your client

The first and foremost step to a successful project is client communication. To this end, it is essential that you understand your client’s concern, so that you can solve the issue accordingly.

It’s best to communicate effectively since the start of the solar roofing, installation, or any such work. Proper communication here that aims to understand the client’s requirements genuinely can help prevent obstacles throughout the project.

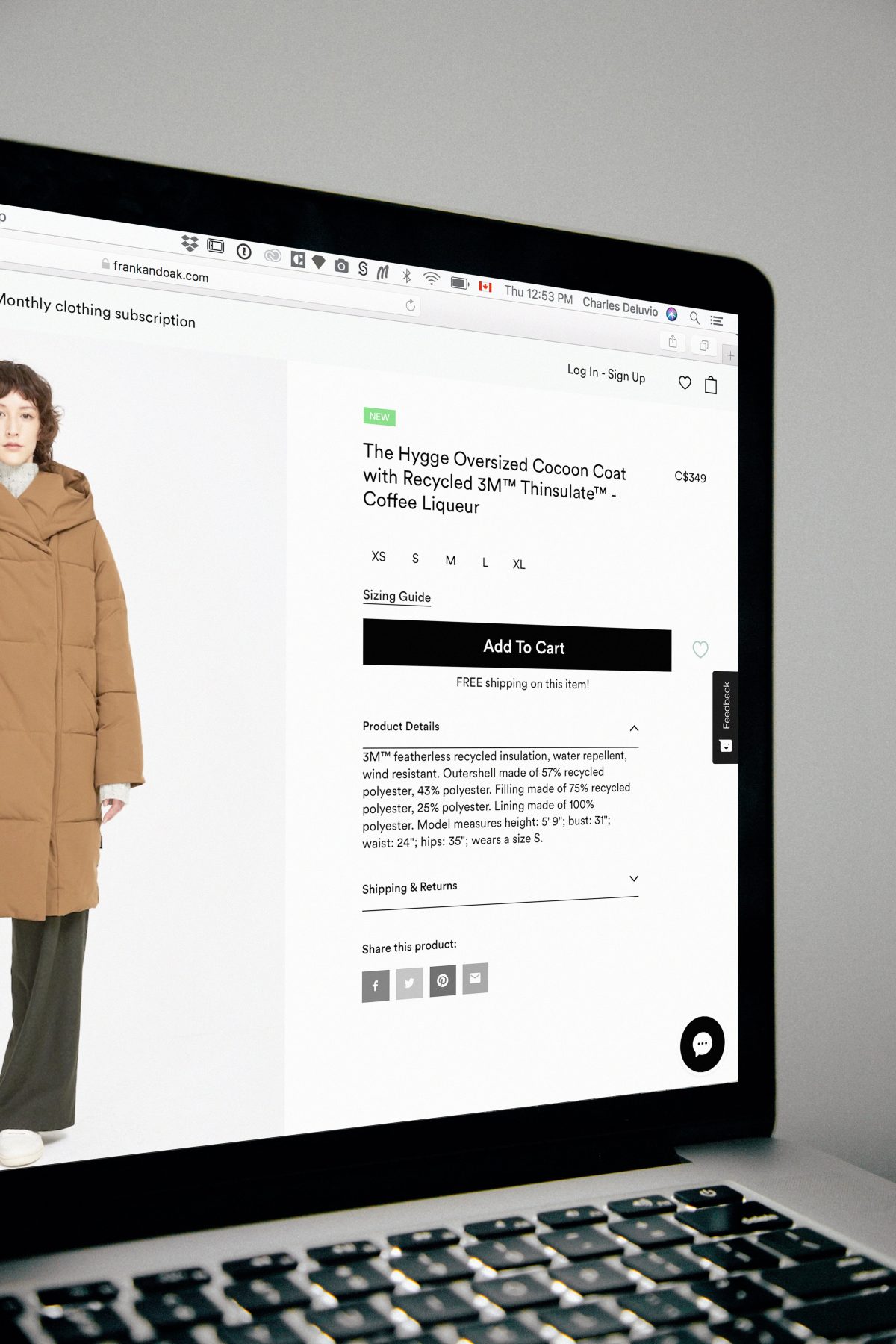

2. Research your audience

Although this step comes before you launch your business, you can always do it later on as well. In fact, audience research continues as your solar business grows. Keep in mind that your business is to serve your audience by providing solar energy solutions to them. And, research is the basic element that can help you comprehend what your customers want.

Understanding your audience via research will help you in two ways majorly. Firstly, you can dive into your customers’ pain points and develop a marketing strategy that focuses on solving those problems.

Secondly, you can get an in-depth look at your clients’ common problems. Once you note these regular issues, you can devise a strategy to solve them, which can assist in removing the complications from your solar projects.

3. Educate your prospects and consumers

A lot of problems surface when existing customers and new prospects fail to understand your services, pricing, or anything else related to the solar PV system. An easy and effective way to solve these issues is by educating your audience.

To this end, you can start an email newsletter, send an informative pdf or leaflet, or blog regularly. As you research your market, you’ll learn what troubles your customers. Take these pain points and convert them into topics for your blog posts.

This tips will not only help simplify your business projects, but help increase your solar sales. A report reveals 81% of the interested buyers conduct online research before sealing a business deal. Furthermore, research confirms that47% of the prospects read at least 3-5 content pieces from your blog before they get in touch.

Hence, by putting educational and valuable content on your site, you show your expertise to your potential clients, which can help boost sales and revenue.

4. Simplify the first steps

More often than not, complications in a solar project arise even before work on the project starts. If you wipe the hiccups in the first stages, you will simplify, at least, half of the process. Moreover, in this way, the entire process of working with you won’t be complication-ridden.

In this context, one of the most common issues consumers face is the lack of contact information regarding the business. You can always help them with the information on where to get solar panel maintenance or anything related to your solar panel systems. So, make sure sufficient contact details including your business number are given on your website.

It is also best that you enhance customer experience on your website by improving its page load speed. Surveys by Gomez.com and Akamai highlight that half of the visitors on your site expect it to load in two seconds or less. Any delay in the page load speed would translate into the prospect abandoning your site and business.

5. Enhance customer experience

Aim to boost customer experience in everything that you do. For instance, striving to communicate well with your customer is one way to boost the client’s experience. When your customer’s experience is good, he feels valued. This reduces the likelihood of your customer getting annoyed when problems poke out of a solar project.

If anything your client will put in more effort into explaining his problem, which can help in reducing and solving the obstacles in the path of project completion. Again, this tip works in favor of your solar sales as a happy customer irrespective of the project complications shares his positive experience with other people.

On the other hand, an unsatisfied customer passes on anti-referrals to about 16 others. Therefore, you should focus on improving the customer experience. Another closely related point is getting customer feedback. This will give you an idea of how you can improve your solar products or installation services business as per your audience’s requirements.

6. Use tech to improve your product as well as services

Lastly, employ technology to solve your complications. For instance, use tech to boost your product quality. On average, solar panels convert less than 14% of the solar radiation into energy.

This is pretty less.

However, by offering another efficiency-boosting tech, you can solve a lot of your customers’ problems. A case in point here is offering solar concentrators. These can optimize the output of the PV system by roughly 50%.

Similarly, you can use software and CRM services to streamline work on several projects and manage things better. This can help chop the odds of snags in your work.

Final thoughts

Complications in your solar projects are inevitable. However, by managing them adequately, you can move forward with your business. The best way to sail through such issues smoothly is striving to understand your client’s problem, trying to effectively communicate with him, and finally putting all efforts in solving the issue.

Bear in mind that the chances of selling to a customer who is happy or getting referrals via him are fourteen times higher than selling to a new prospect. Therefore, you can’t choose to ignore these issues. If anything, work to remove them from the start or boost the quality of your work as you gain experience in your line of work.