Today, there are more cryptocurrency exchanges than ever before. In fact, popular platforms have started offering whitelabel services for anyone to start a new platform. The way these platforms work is simple. Users who want to buy and users who want to sell come together to trade their cryptocurrency, in hopes of profit. The total amount (in USD) of these trades, forms the daily volume of the platform.

Since platforms like these started becoming popular with the public, daily volumes were a solid method to understand how popular a platform is, as well as its ability to provide liquidity to smaller altcoins.

In time, however, the reported daily volumes started to seem somewhat inaccurate. The top exchanges seemed to be relatively unknown, sometimes even unheard of.

Many traders started to question the validity of those daily volumes. Is it possible that an exchange with a mere 2000 Facebook makes more than $10 million in daily volume? Wouldn’t there be a more active community to support this?

As a response to this inconsistency, the asset management firm Bitwise decided to explore the topic in further detail. The investigation led to a 104-page whitepaper which revealed some shocking findings.

Exchanges artificially inflate their volumes

The analysis of Bitwise led researchers to an eye-opening, yet not shocking, conclusion. Most cryptocurrency exchanges were artificially inflating their reported volumes using a variety of methods.

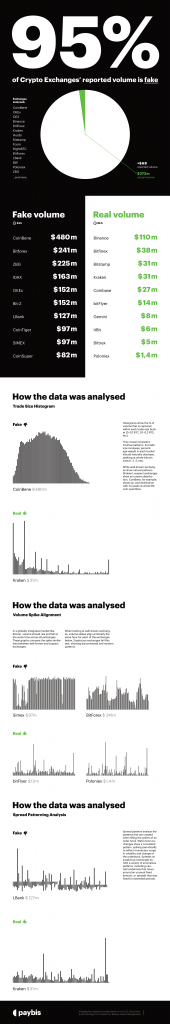

What did surprise the researchers was the vast amount of platforms engaging in such practices. More than 95% of the reported volume was actually nothing but smoke and air. Non-existent!

Why would these platforms purposefully ruin the reputation of the crypto markets? Well, to understand this, we need to look at CoinMarketCap. The popular tracking platform includes a list of the most popular exchanges’ reported daily volume. The higher this volume is, the more they can request for new altcoin/ICO listings. It also makes these platforms more visible to new investors.

Of course, this misinformation does not serve investors. In fact, it makes the space less trustworthy. So how can one then find platforms that are actually transparent with their customers? Thankfully, Bitwise managed to discover all exchanges that reported the actual trading volumes of their platform.

In efforts of making the findings easier to understand, Paybis created a helpful infographic. Check the following overview to get a better understanding of Bitwise’s findings.

The findings of Bitwise’s research report was disheartening for crypto-enthusiasts. Some even argued that the purpose of this research was to create more FUD in the market. CoinMarketCap, however, validated the findings and introduced new metrics to fix the issue at hand. In late 2019, the company introduced the Liquidity metric. Using this metric as a filter gives more reliable results and helps users better distinguish platforms that are trying to improve their image using shady methods.

A short while ago, CoinMarketCap got acquired by Binance, and the Reported Volumes metric finally started showing information in a more transparent way. The information now looks a lot more realistic and favors the platforms that have been doing all the hard work in the past few years.

2020 and beyond

The cryptocurrency sector is still making its first steps as an investment option. The good news is that the metrics of data collection keep improving, together with the crypto space itself. In time, irrelevant platforms will not be able to sneak into top listings using unethical methods.

Additionally, Binance seems to have set the new standard when it comes to the operational practices of crypto exchanges. Thanks to its multiple acquisitions, it is no longer possible to build a strong brand without being compliant to the new industry standards.