Video marketing is a sales strategy in which audiovisual pieces are used to promote a product or service, mainly online. In short, it is about adding videos to your online marketing strategy, through different platforms.

Here, you will see the different reasons why you should use video marketing in your online strategy to improve your communication to your target audience, as well as a series of tips and the different channels that you can use to broadcast your audiovisual messages.

This type of marketing is booming in our society; you have to take a look at the data of recent months, which reveal that nine out of ten people see the videos of the brands they like. And more than 65% of these people visit the website of the brand in question after viewing the video.

A bit of data

The online audiovisual content has a significant consideration today. It has become a key player among the population. An average user watches 66 minutes of online video per day. The audiovisual content already exceeds 70% of the entire volume of the network, estimating that it will reach 84% by the end of 2018 according to a study carried out by Accenture.

The so-called Generation Y or “Millennial” (young people between 18 and 34 years old) is having a significant weight. They are modifying the way to receive advertising. This generation has changed television hours by watching online video. These viewers watch 20 hours per week of video on the internet, compared to 8 hours of television (Adweek data). This means that television campaigns are less seen by this young public. It is therefore imperative that companies adapt and seek new ways to reach this part of the population.

Why you should use video marketing

The reasons for using video marketing are innumerable. These are some of them:

- Message: A message transmitted audiovisually is much more effective, precise and comprehensible to the general public. One minute transmits the same information as 1.8 million words. A video allows you to express a message with many more resources, getting a more creative and emotional message. Also, when reaching the user through several senses, 80% of consumers remember the brand better if they have seen an audiovisual content about it.

- Leisure: Watching videos does not require any effort on the part of the viewer, and they are associated with leisure. Therefore, it is easier to capture and maintain the user’s attention than with a written text.

- Virality: Audiovisual material is the most susceptible format to be shared and therefore to be a viral content. 90% of shared videos appeal to emotional and humorous content. The important thing is to know what the audience is looking for so that more people share the content.

- Purchase: The audiovisual content of a page helps the decision of online buyers. 85% of users say that they are willing to buy pages with videos about the product, as it makes it more attractive and provides extra information about its content or operation.

- SEO: The videos help the positioning of your web page. Specifically, there are 50 times more chances to appear on the first page of Google. Thanks to audiovisual content, users spend more time on the website for its reproduction. Also, the more you share the video, the more visits your web portal will have.

Types of Video Marketing

To know what is best suited to your company, we will differentiate between different types of video marketing:

Advertisers: They are classic television spots, which can also be distributed by online media.

Corporate: Those that show the functions and values of the company. It is the presentation of the entity in an audiovisual way.

Portfolio: They show the different professional jobs of the company so that the client sees their best work.

Demonstrative: They are the ones that show the operation, characteristics and advantages of a product or service. Highlighting its value and importance, and thus encouraging its sales.

Tutorials: Explanatory pieces that offer training on one of the company’s products, positioning themselves as experts in the sector.

Testimonials: They reflect the experiences and opinions of real customers about products and services of the company.

Events: They show the presence of the company in important events of the sector, increasing its value and leadership in the guild.

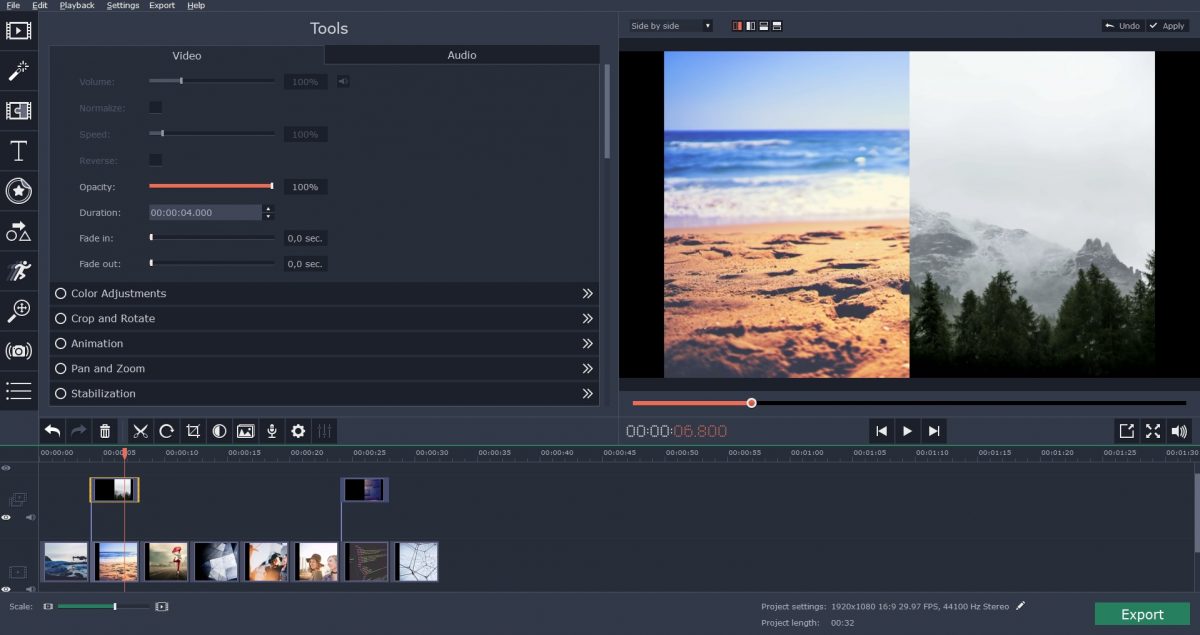

Broadcast channels for Video Marketing

For a video marketing campaign to be a success, the distribution platform must be chosen correctly. The most successful channels are the following:

Email marketing: Thanks to the video marketing implanted in the mail, you ensure the attention of the viewer from the first moment you open the mail since the video will be played immediately, thanks to tools such as Autoplay. The success of this method is explained in that it is the user who has asked to receive information about the company and will pay much more attention and interest to a video than to a written text. Also, we will avoid distractions from the traditional advertising of e-mail providers.

Youtube: It is the largest and most important platform for videos on the internet. In a month, more than 5,000 million hours of audiovisual content are displayed, uploaded by the users of the platform.

There are different ways to use YouTube. The first is to use free video marketing. It consists of uploading videos of the brand to its official channel, which can be viewed through a link on the company’s website, or on the Youtube platform. The second is to use tools like Trueview. With the payment of a fee, the video of your brand will appear at the beginning of the video that the user wants to see, as an advertisement. Videos of less than three minutes are the most successful.

Other broadcast channels for video marketing are Vimeo and social networks such as Facebook, Twitter, and Instagram.

Tips to succeed in video marketing

Finally, here are some tips to help you succeed with your video marketing campaign:

Starts strong: The first seconds of your video marketing is the most important. You must capture the viewer’s attention from the start.

Pass a message: Your video should convey valuable information about the product or service that is promoted, convincing the viewer that yours is the best in the competition.

Be consistent: If you make videos promoting your brand frequently, the viewer will know it better and will tend to consider it as the main one in case you need a product.

Feelings: Videos that use humour or emotions are the most persuasive when it comes to selling a brand. Try to provoke an emotional response. This way, the viewer will remember the brand much better.

Brevity: A video marketing should last less than two minutes. The less, the better, to avoid taking the time of the users and having a bad image of the brand.

Action: Your video should end with a call to action. A web page or purchase link is enough. This serves so that the spectator becomes a client.

Author Bio:

Melissa Crooks is a Content Writer who writes for Hyperlink Infosystem, one of the leading app development companies in New York, USA & India that holds the best team of skilled and expert app developers. She is a versatile tech writer and loves exploring the latest technology trends, entrepreneur and startup column.